-

What Are The Seven Components Of Conducting A Talent Assessment?

A talent acquisition assessment is a process used to evaluate an individual’s abilities, skills, and potential […]

-

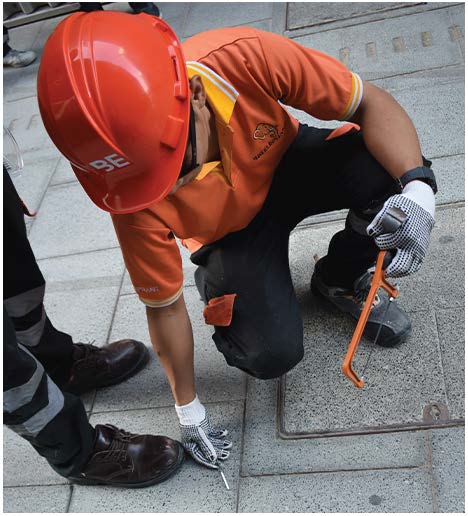

The Basics Of Property Maintenance

Property maintenance is taking care of and repairing a property to keep it in […]

-

Essential Equipment You Need To Establish Your Construction Company

Getting started in the construction industry can be tough. You need to consider the […]

Dubai, UAE

9AM – 6PM

info@e-startuparena.com

24 / hrs Support

Our Business consultancy service that can help your company grow in Dubai. We have over 10 years of experience

Plan for Work

Through plans, you break down a process into small and identify the things you accomplish.

Implementation

To carry out put into action performto implement a plan. archaic to complete

It involves handing over to customer, passing the documentation…

10 +

Years

Experience

ABOUT US

All the information that you need is now easily accessible

It’s never too late or too early to start something new. Everyone has ideas but not everyone knows what it takes to make those ideas come alive. Our goal is simple – we want people who are interested in entrepreneurship to succeed! That’s why we provide everything from tools and tips for success to latest news about the business sector in Dubai!

We are dedicated to helping entrepreneurs, startups, small businesses and freelancers succeed in their ventures. Our aim is to help people get started by providing them with the tools they need to grow their businesses. Whether it’s finding funding or getting your website up and running, we have all the resources you need right here at EStartUp Arena!

- Planing your Future Better

- Financial planing for safe investment

- Experience a brand new financial attitude

- Your financial matters according our plans

Marketing can not work without analytics

We believe in successful go to market execution is key to revenue growth. We can help you to deliver brand awareness in engagement business performance.

Integrated Support

We will connect you with the people and organizations who can help your business succeed.

Smart self services

Our team wants to see businesses in Dubai succeed, and we are committed to helping …

How Can I Help You

Your results are our top priority!

Strategy Consulting

Corporate and growth strategy. We advise clients on developing strategic opportunities by providing in-depth market, competitor and customer insights.

Manage Investment

Management includes devising a short- or long-term strategy for acquiring and disposing of portfolio holdings. It can also include banking, budgeting, and tax

Corporate Finance

We offer following Business Financial Planning & Advisory Services to help companies thrive over the long term.

Our Services

We provide the best services

The main benefit of having an online business is increased brand awareness

Market research is the process of evaluating the viability of a new service…

Business strategy is the strategic initiatives a company pursues to create value…

We provide professional project management services to a number of clients worldwide.

Learn how good money management is largely a matter of making good decisions

We provide professional digital marketing services to give you the best digital

How Can I Help You

Giving Smartness To

your Business

Business Planning

eStartupArena is a professional business consulting firm that offers a wide range of Business Planning services to entrepreneurs, startups, and established businesses. With a team of experienced consultants, eStartupArena provides strategic guidance and practical solutions to help businesses achieve their goals and maximize their success.

- Retail

- Education

- Stock Trading

- Industries

- Healthcare

- Technology

Consulting Services

eStartupArena offers a comprehensive range of consulting services to assist startups and entrepreneurs in navigating the challenges of building and scaling their businesses. With a deep understanding of the startup ecosystem and industry best practices, our team of experienced consultants is committed to helping you achieve your business goals.

- Startup Strategy Development

- Business Planning and Financial Modeling

- Market Research and Analysis

Strategy Buildup

eStartupArena is a leading provider of Strategy Buildup services for startups and businesses. We offer a range of comprehensive services designed to help organizations develop and execute effective strategies to drive growth and achieve their goals. Here are some of the key Strategy Buildup services provided by eStartupArena:

- Competitive AnalysSis

- Strategic Positioning

- Growth Strategy Development

With Respect To Each Customer

We Appreciate Clients

And Their Business

Testimonials

What Clients Say About Us

Working with eStartupArena has been a game-changer for our business. Their expertise in digital marketing and startup growth strategies has helped us reach new heights.

Sara Taylor

Founder/ CEO

We are extremely grateful for the support and guidance we received from eStartupArena. Their comprehensive knowledge of the startup ecosystem

Jason Smith

CFO

eStartupArena has been an exceptional partner in our journey to establish a strong online presence. Their team of experts has a deep understanding of digital marketing

Elwin Dawson

Founder/ CEO

NEWS